Happy Fall!

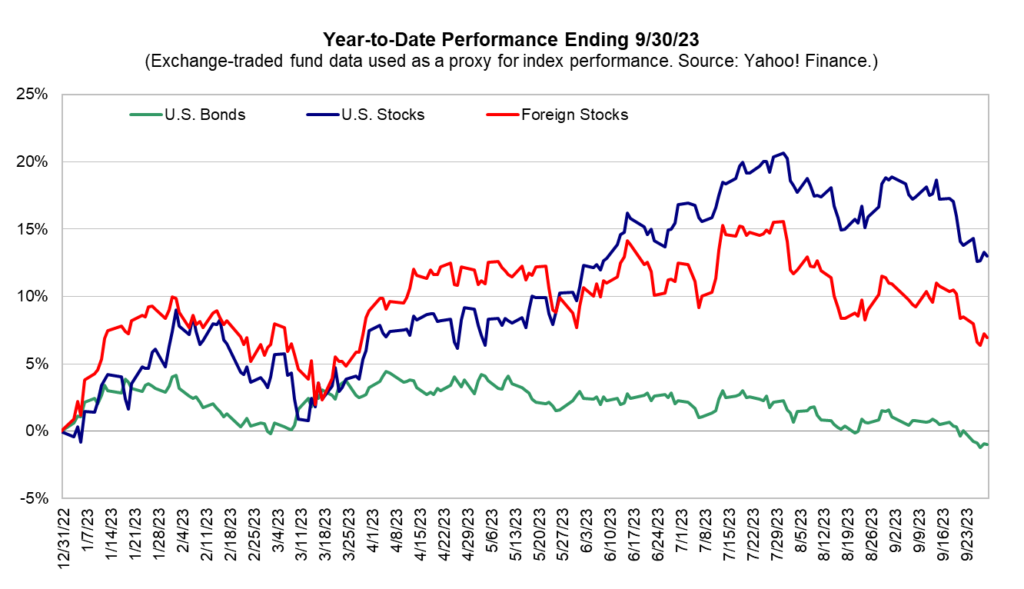

Fall is such a lovely time of the year and this one has been following the script so far here in Southeast Louisiana. With a nice rainy transition right on time with the solstice we now have had a collection of cooler mornings and sunny days to enjoy. Fall is often the time of year when markets get volatile as well and, just as with the weather, this year has been adhering to the playbook. After July’s positive numbers both August and September were negative for many sorts of bonds and stocks with commodity securities and cash bucking the trend.

Markets have been concerned with the potential for interest rates to be higher for longer than were anticipated earlier this year and these concerns were exacerbated by the prospects of a government shutdown. While it appears that the near-term shutdown has been avoided, we will certainly see more political maneuvering as Congress grapples with the implications of increasing interest rate expenses and how they affect discretionary spending and budget deficits now and in the future.

Of course, there is more to keep markets worried over the next few months. Along with rising interest rates is the strengthening dollar, making US goods and services less attractive to those outside our borders. Oil prices have been ticking up and that, along with the resumption of student loan payments and the inflation we’ve seen in the prices of most everything threaten to hit the economy as folks pull back on spending. China, long the growth darling of the world has slowed a bit with their own economic malaise. And here at home the prospect of additional fights over government spending and another potential shutdown have only been put off until next month.

Looking at the economy however growth is still the order of the day. The Conference Board (the folks in charge of measuring national economic growth) is predicting growth in GDP again in the 4th qtr. Analysts see Q3 year over year corporate earnings just about flat, although many are predicting a return to corporate earnings growth in the 4th quarter and in 2024 as well. GDP projections from the Conference Board remain modestly positive for 2024 although they do concede the possibility for a mild recessionary period sometime next year.

As the saying goes, markets tend to climb a “wall of worry”. This tendency seems to be a function of the forward-looking nature of markets. Once all the bad news is on the table it is time to start looking for better times ahead. While we’re not perhaps at that juncture just yet sooner or later we will be. Markets are already starting to look ahead to the first or second quarter of 2024 with the guarded optimism a new year brings.

Capital markets see the economy as playing a supporting role in the growth of corporate profits over time. There are other considerations of course, interest rates play a significant role in the relative appeal of corporate profit growth to an investor. Valuations play an important role too as no one wants to pay too high a price for a growing company although those considerations are again relative depending on the rate of growth expected.

We do know that one very effective portfolio strategy during recessionary times is the diversification benefit of multi-asset portfolios, those with stocks, bonds and alternative asset classes included. Given current yields bonds could provide a significant cushion if the economy does soften and the Fed starts to think less about controlling inflation and more about helping the economy through a soft patch. If inflation does continue above the Fed’s target owning stocks will help to keep abreast of higher prices as companies raise prices in line with their own inputs for materials, worker salaries and profit targets.

We try to make changes in your portfolio based on relative valuations in the various asset classes. For stocks the higher valuations in some of the larger technology and information companies have made the inclusion of an emphasis in value stocks, with their lower relative prices, desirable. That has helped cushion portfolios over the last few months as the high flyers had their wings trimmed a bit.

Bonds certainly march to a different drummer. The discussion here, played out in the markets each day, has to do with credit quality and interest rates. While the continued interest rate increases of the last year took their toll on many sorts of bonds, those bonds with a floating rate feature (whose rates rise with the market) have helped to blunt the interest rate declines in the broader bond segment of your diversified portfolio. Because credit quality is a consideration and because floating rate bonds have slightly lower credit qualities, economic growth or lack thereof will influence these bonds as lower rate companies inherently carry more credit risk and those risks are exacerbated in a weak economy. We’ll continue to monitor that part of your portfolio for an effective exit point.

Market declines are never any fun and this one is no exception. Even while we know that episodes of falling prices for stocks and bonds are part and parcel of investing it can be disconcerting to watch our portfolio value shrink over any particular period. While we don’t know how this next quarter or year will unfold, we do know that staying diversified and staying invested is the key to success over time.

I appreciate your trust and confidence.

Best regards,

Jeff Christian CFP, CRPC

Patience is necessary, and one cannot reap immediately where one has sown. – Soren Kierkegaard

Securities and Registered Investment Advisory Services offered through Silver Oak Securities, Inc. Member FINRA/SIPC. Armor Financial Group and Silver Oak Securities, Inc. are separate entities.